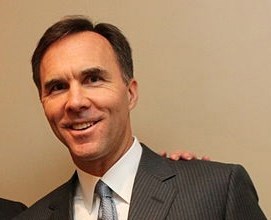

Finance Minister Bill Morneau and officials from his office have responded to a roundtable on proposed federal tax changes. Red Deer-Mountain View MP Earl Dreeshen held that roundtable at the Olds Legion on Aug. 23. It attracted about 30 people.

According to a Finance Department official, "there is evidence that some high-income individuals are using corporate structures to avoid paying their fair share (of taxes).

"These tax planning strategies are legal, but that doesn't make them fair," the official says. "The government's goal is to build confidence in our economy by closing tax loopholes, while ensuring that companies continue to benefit from Canada's highly competitive tax regime."

The official said in regard to so-called "passive investment income" under which a business owner invests income for reasons other than immediate reinvestment into the business, and may use it as a source of retirement income "it is the government's intent that any tax changes will apply only on a go-forward basis and will have limited impact on existing investments."

Noting the deadline for responses to the proposed changes is Oct. 2, the official said, the federal government will ensure that "all views are taken into account."

When he announced the proposed changes, Morneau said, "this is becoming an even more pressing issue as Canadian controlled private corporations are making up an ever growing share of our GDP, doubling in the last 15 years."

Morneau said Canadians "expect the government to put in place rules that will help grow the economy and create jobs and also to ensure that these rules are not taken advantage of by some who can afford fancy accounting schemes."

"The issues we're working to address will have no impact on a private corporation's ability to invest in and grow their business, reach new customers or hire new people," he added.

"The issues we're working to address will have no impact on a private corporation's ability to invest in and grow their business, reach new customers or hire new people." BILL MORNEAUFEDERAL FINANCE MINISTER