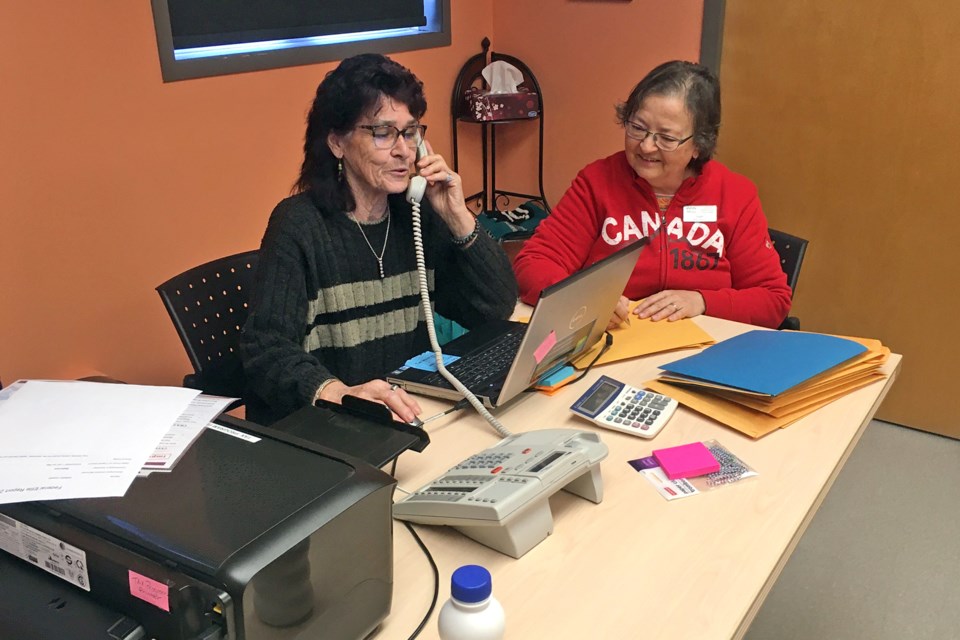

SUNDRE – The Community Volunteer Income Tax Program delivered in Sundre through a local non-proft service organization provides at no cost a much more personalized touch than anything an auto-filing software ever could.

“A lot of people – especially seniors – have questions,” Renate de Bruijn, Community Outreach Coordinator at Greenwood Neighbourhood Place, told the Albertan.

“So, it’s nice to just speak to a person I think,” said de Bruijn.

Vetted volunteers that are involved in the program – which runs from the beginning of March until the end of April – process and file hundreds of simple tax returns on annual basis, she said.

“We did more than 300 last year,” she said, adding that as of the end of March, the core crew of nine volunteer had already filed 159 returns.

“They’re still coming in,” she added.

While there remains some time before the tax filing deadline, de Bruijn encourages people not to procrastinate as there can potentially be financial repercussions that have a harder impact on folks with a fixed income.

“We advise people to file their income tax before the end of April,” she said.

“Especially seniors, so they don’t miss out on the benefits and their old age pension,” she said, adding that failure to file on time runs the risk of delaying certain payments that some people might depend on.

“Everybody should have filed before the end of April to be secure that their benefits are not being cut off,” she said, referring to GST and carbon tax rebates as well as old age pensions.

However, recognizing that life has a tendency to occasionally throw curveballs, the society strives to make the service available throughout the year.

“We have a few volunteers in town that do them from home because they’re bookkeepers-slash-accountants, so they’re also part of the program,” she said.

But as much as possible, she urges people who are in a position to file their returns prior to the deadline to do so.

The program provides assistance to individuals who earn up to $35,000 per year as well as couples with an annual income of up to $45,000 plus an accommodation of an additional $2,500 for each dependent.

As the service is intended for simple tax situations, the following returns do not qualify: self-employment, business or rental income, capital gains or losses, bankruptcy, or any deceased in the past year.

Anyone who is interested in serving as a volunteer must first be approved by the Canada Revenue Agency, which takes about 30 days to go through, as well as undergo a police record check, said de Bruijn.

“If they want to be a greeter, I (already) have all my schedules done now for this year,” she said.

Greeters are volunteers who “are just taking the forms in and they check if all the information is there that we need … and then they take the forms to go to the income tax preparer who will then file the income tax.”

In essence, the greeter is the point of contact who helps people make sure they’ve got all the paperwork they’ll need to properly file their returns.

“So it’s like a two-step and a two-person procedure,” she said.