Last week, the Albertan reported on a local woman who was almost scammed by a fraudulent classified ad that ran in the Mountain View Gazette. A bank teller caught the fraudulent cheque in time. But some people aren't as lucky.

Last week, the Albertan reported on a local woman who was almost scammed by a fraudulent classified ad that ran in the Mountain View Gazette. A bank teller caught the fraudulent cheque in time. But some people aren't as lucky. Here's how scammers are trying to trick you, and what you can do to keep yourself from falling prey.

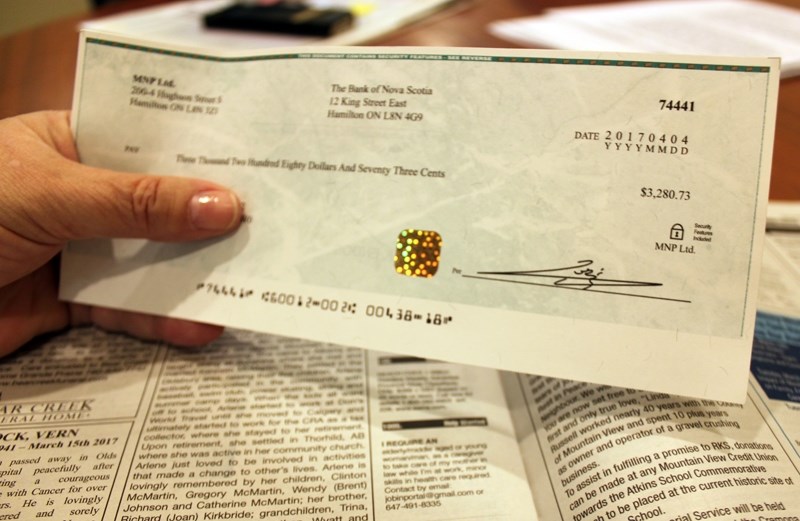

Madonna Girletz answered the job post seeking a caretaker for an elderly parent, and received a cheque by FedEx, ostensibly her first weeks' pay plus funds to be forwarded to a local store manager for supplies. After ScotiaBank told Girletz she was holding a bad cheque on April 7, she reported it to the Olds RCMP. The police, however, were unable to open a file – since the cheque wasn't cashed, no fraud had actually been committed.

Instead, the RCMP advised Girletz to contact the Canadian Anti-Fraud Centre. The centre can then forward that information to local authorities, which might help in identifying and prosecuting individuals when crimes are committed.

Scammers are often playing the entire field. In this case, they went to the trouble of purchasing a classified ad in a small newspaper, provided a local address skimmed from real estate listings, paid with a credit card in a different name, used business cheques from an unrelated company, drawn on a bank that no longer exists. According to Mountain View Publishing, the alleged scammer also claimed to be hard of hearing, wanting to do the ad placement entirely over email.

In hindsight, it's easier to see how these things don't add up. But each party only has one piece of the puzzle, making it harder to catch on. Often it comes down to intuition.

For Girletz, she said it was "just little stupid things." Questions like why, if you're a big corporate person, would you be moving to Bowden? And why they were so quick to offer her the position, without having met or spoken to her.

"How do they know I am trustworthy?" she said. "They're counting on me as much as I am counting on them."

When it comes to not being fooled, it helps to pay attention to that 'spidy sense.'

Cpl. Michael Black, an officer at the Olds RCMP detachment, says that, unfortunately, it tends to be a buyer-beware situation. That means people need to be suspicious, and ask questions when something doesn't seem right.

"If it's too good to be true," said Black, "it probably is."

Black said it can be hard to track down the players involved in these kinds of cases. The fraudulent activity is often originating in other jurisdictions – in this case the job post gave a Toronto phone number. Meanwhile, Black said, victims are often more concerned about recovering what they've lost, than they are in laying charges.

Dale Mackie, branch manager for ScotiaBank in Olds, where Girltz took the cheque to be verified, says that at the end of the day, each person is responsible for not letting themselves be defrauded, and that people need to be aware of the various scams out there.

He said that this particular scam, called an overpayment scam, is common. It takes different forms, but amounts to the same thing: someone overpays you for something and then asks to be paid back.

Mackie said there are also common features of fraud. A first indication is that somebody has reached out to you, instead of you seeking them. Secondly, there is often pressure involved, an attempt to get you to do something and to do it quickly.

The best strategy, he said, is to ask questions. And of course, that old adage seems to be the standard when it comes to scams.

"We've got to go by the old rule," said Mackie, echoing Black, "if it sounds too good to be true, it most likely is."

BE AWARE: Two good resources are the Competition Bureau Canada's Little Black Book of Scams, which is available for free online, and the Canadian Anti-Fraud Centre, which describes how various scams work, at www.antifraudcentre.ca.

BE SUSPICIOUS: The rule seems to be: if it's too good to be true, it probably is. Ask questions from both the person you are doing business with, as well as a third party, including your bank and the Canadian Anti-Fraud Centre, which you can call toll free at 1-888-495-8501.