INNISFAIL – Town council has approved the 2024 Property Tax Bylaw and the 2.8 per cent tax increase first approved last December will be one of the lowest seen this year by any municipality in the province.

Without taking into account property assessment changes, a property in Innisfail that is valued at $350,000 for 2024 will see a total tax increase of $48.47 for the entire year.

However, if the assessed value on a home goes up so will the tax increase, or down if the assessed value has dropped.

“We are very happy. Administration has done extremely well on keeping the mill rate increase to 2.8 per cent,” said mayor Jean Barclay. “You have to be very cognizant about affordability. That’s such a huge issue right now.

“But at the same time municipalities are no different than other businesses or even households that are experiencing high inflationary costs these last few years.”

Erica Vickers, the town’s director of corporate services, presented council with a full and detailed report to consider before it approved three readings of the 2024 Property Tax Bylaw.

Her report offered a 2024 tax increase comparison with several other communities across Alberta and Innisfail’s 2.8 per cent is one of the lowest in the province, with most of the revenues from that increase going towards future debt.

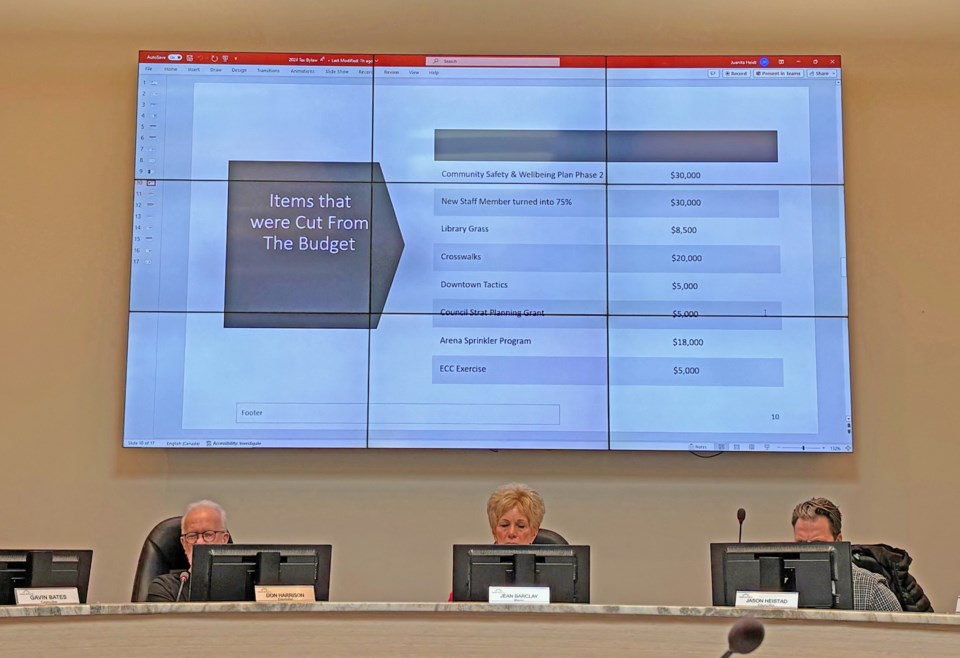

Vickers noted that on Dec. 13, 2023 council approved the 2024 operating budget with this year’s tax requirement of $12,380,473. This included a 2.8 per cent tax mil rate increase.

Council was reminded by Vickers that during the 2024 budget deliberations administration presented an estimated tax assessment to council and used those numbers in calculating the total tax requirement.

She said the budgeted amount for the municipal portion was $9,361,526.

“We have received the official assessment in February 2024 and as shown in the attached property tax estimate the town is seeing an increase in assessment of $23,200,130 from our estimated figures,” said Vickers in her report to council. “This gives us a slight overall assessment growth of 1.88 per cent.

“The increase of assessment, coupled with the 2.8 per cent tax increase, we are seeing a tax amount of $9,491,882, which is an increase of $130,356 over our budgeted amount.”

Vickers then proposed various options to council on what it could do with the extra $130,356.

She said the town’s provincial Local Government Fiscal Framework (LGFF) funding for infrastructure work in 2024 is underfunded by about $100,000.

Vickers added $100,000 of the $130,356 surplus can now be transferred to the 2024 Surface Improvements capital project, with the remaining $30,356 going into the RCMP reserve to help pay for a future back payment that could come from the Mounties’ next collective bargaining agreement.

“I will be bringing forward at the next council meeting a budget adjustment to identify that increase of $130,356 and where that's going to go,” said Vickers. “I just need to update our financial accounts, and that will take another council motion on April 22.”

Vickers told council that administration will present 2023 4th quarter financials and surplus allocation, along with the 2023 audit at a future regular council meeting.

She said the projected 2023 year-end surplus will be about $780,000 with more than half of that coming from increased investment interest.

“Administration felt that this should be disclosed to council prior to the mill rate bylaw being passed,” she said

With the 2024 Property Tax Bylaw unanimously passed by council on April 8 the 2024 Assessment and Taxation notices will be sent out no later than April 17 to give residents the mandatory 67 days to file an appeal on or before June 30.

Taxes must be paid without penalty on or before the June 30 deadline. Further penalties are applied as follows:

• July 1, 2024 - eight per cent current outstanding balance

• Sept. 1, 2024 - four per cent current outstanding balance

• Jan. 1, 2025 - 12 per cent total outstanding balance